|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

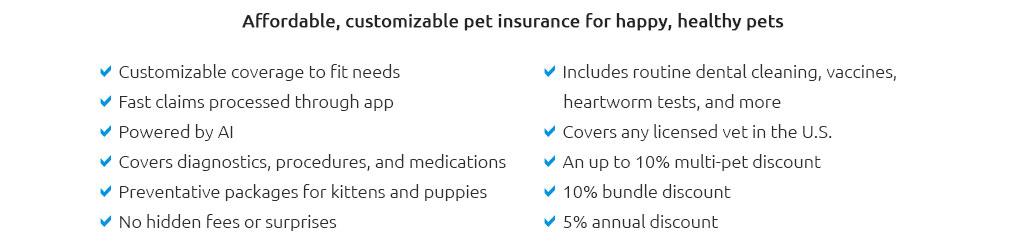

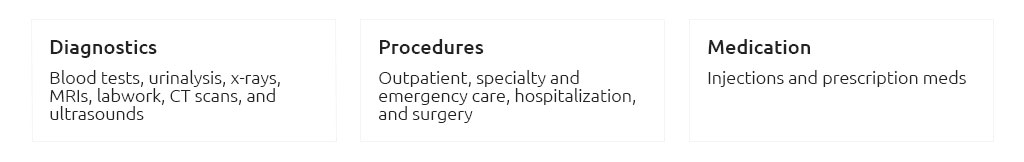

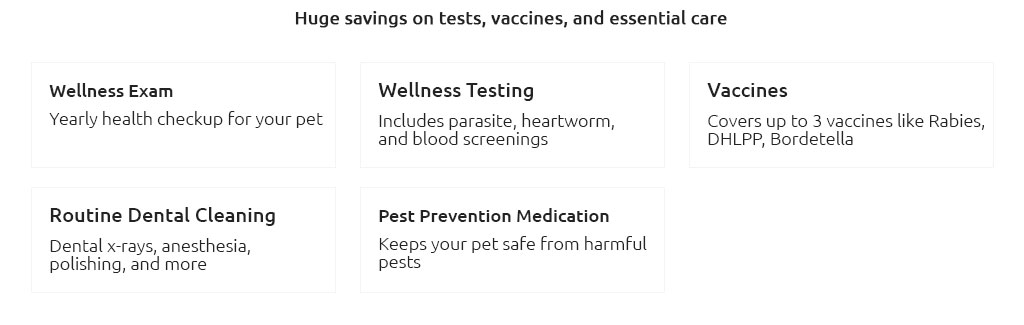

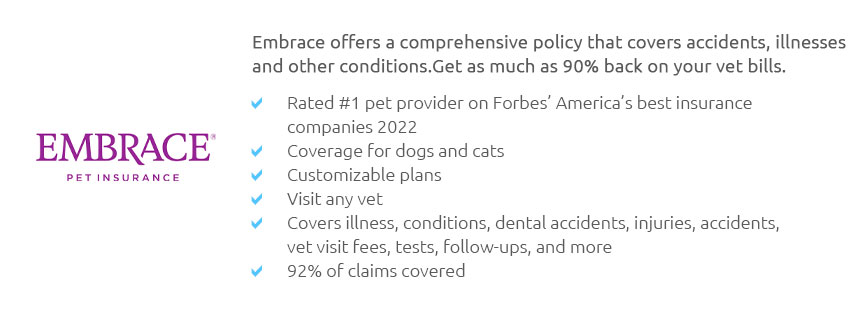

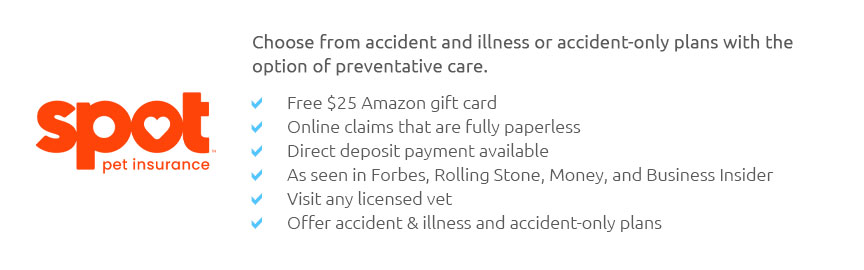

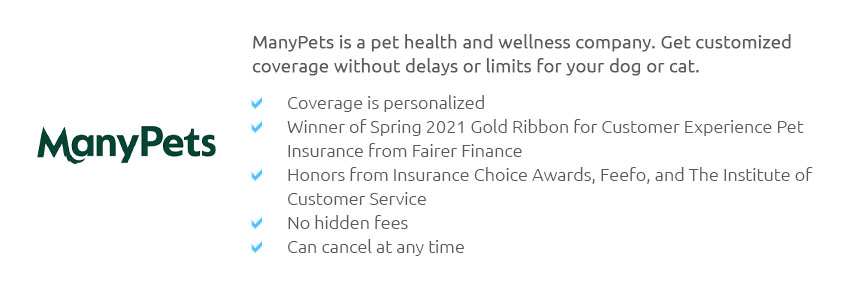

The Importance of Buying Pet Insurance: What to ExpectWhen it comes to making sure our beloved pets are safe and healthy, pet insurance is often a subject that surfaces in conversations among pet owners. This article delves into the nuances of pet insurance, shedding light on what you can expect from this seemingly complex but crucial decision. From understanding the different types of coverage to evaluating the potential benefits, this exploration aims to equip you with the knowledge needed to make an informed choice. First and foremost, it's essential to recognize that pet insurance operates much like health insurance for humans. It offers coverage for unexpected veterinary costs, which can arise from accidents, illnesses, or even routine care in some cases. The financial relief that comes from having a policy in place is a significant factor that motivates pet owners to invest in insurance. However, before diving into any commitment, it's wise to consider the specific needs of your pet. Different breeds and ages may have varying requirements, and understanding these can guide you to select the most suitable policy. While researching policies, you'll encounter various types of coverage. Generally, pet insurance can be categorized into three main types: accident-only, accident and illness, and comprehensive plans. Accident-only policies typically cover unforeseen incidents such as injuries, while accident and illness plans extend their coverage to diseases and chronic conditions. Comprehensive plans, on the other hand, may also include wellness care like vaccinations and regular check-ups. Each type of policy has its benefits and drawbacks, which leads to the critical aspect of evaluating what aligns best with your situation and budget.

Another important factor to consider is the cost of premiums, which can vary significantly based on several factors such as your pet's breed, age, and pre-existing conditions. It's worth noting that older pets and those with prior health issues might incur higher premiums or face restrictions. Therefore, initiating coverage when your pet is young and healthy can be a prudent financial move. Furthermore, as you sift through potential providers, pay attention to the details of the policy, including deductibles, reimbursement levels, and annual caps on payouts. These elements can greatly influence the overall value and effectiveness of the insurance. In the realm of pet insurance, there's also the question of how claims are processed. Most insurance companies require you to pay the vet upfront and then file a claim for reimbursement. This is an essential consideration, especially if you're concerned about cash flow. Familiarizing yourself with the claims process and turnaround times can save you from potential stress during emergencies. Beyond the technicalities, it's crucial to reflect on the emotional benefits of pet insurance. The peace of mind knowing that you won't have to make difficult financial decisions in the face of a medical emergency is invaluable. It allows you to focus on what truly matters-the well-being of your furry family member. Investing in pet insurance is not just a financial decision; it’s a commitment to ensuring that your pet receives the best possible care throughout its life. In conclusion, buying pet insurance is a decision that requires careful consideration of numerous factors, from the type of coverage to the specifics of the policy and the unique needs of your pet. By understanding what to expect and evaluating your options thoroughly, you can make a choice that not only safeguards your finances but also ensures that your pet receives the care it deserves. In a world where veterinary costs are on the rise, having a reliable insurance policy is more than a luxury-it's a necessity for responsible pet ownership. https://www.usnews.com/insurance/pet-insurance

Before buying a policy, look at your past vet invoices and assess your dog's annual wellness costs to see if this coverage is worth the investment. How To Find ... https://naphia.org/find-pet-insurance/naphias-pet-insurance-buying-guide/

Pet health insurance is a unique, specialized coverage designed to reimburse pet owners for unforeseen veterinary fees and related expenses. https://www.aspcapetinsurance.com/resources/pet-insurance-buyers-guide/

Pet Insurance Buying Tips - Balance cost and coverage - Be sure to balance the cost of your monthly premium with the kind of coverage you want for your pet.

|